Washington and Annapolis Offers a “Carrot,” Other states choose the “Stick” to Encourage Employers to Offer Retirement Savings Programs

May 9, 2023

The Maryland Veterinary Foundation (MDVF) is excited to announce the launch of its first-annual "Unleash Your Inner Animal" Photo & Video Contest . This innovative fundraising event aims to support veterinary students in Maryland by raising $25,000 for scholarships. About the Contest: The "Unleash Your Inner Animal" contest invites veterinary practices and the public to participate in a fun, team-building activity. Participants are encouraged to create and submit creative animal-themed photos or videos. The contest is designed to engage the community, foster creativity, and support future veterinarians.

The University of Maryland Department of Veterinary Medicine has been cleared to collect samples as part of a research investigation into the causative agent to help our Maryland veterinary community and not as a fee for service diagnostic service . Participation and sending samples is encouraged and voluntary - at no cost - other than shipping to the veterinary clinic. The results will be communicated as a research report about the findings of the investigation and not on individual cases basis. As such the department of veterinary medicine is covering the cost of this investigation. It must be emphasized that at this time UMD is cleared to receive and store the samples that meet their criteria for running metagenomic sequencing for investigation purposes. They will not be able to process samples until full protocol approval which they hope will happen on December 13. In addition, turnaround time on the final study report cannot be predicted as it depends on many factors including IBC protocol approval process and how quickly enough samples can be collected to run the testing. Download the sample submission protocol HERE

As many of you know, concerns about an outbreak of atypical canine infectious respiratory disease (CIRD) have been reported in areas all over the United States. This has dominated media outlets early in this holiday season. At this time, we are told several cases have been reported recently although we do know the actual number of cases reported. The Maryland Veterinary Medical Association (MDVMA) is aware of the concerns of the citizens of Maryland. CIRD is a broad term to describe known bacterial and viral causes of lung, trachea (throat), and nasal disease. The problem with atypical CIRD is that it does not always respond or behave like common CIRD. There has been very little and consistent data reported as the definitive pathogen causing this illness. Different states are reporting different things with some known pathogens being isolated and some are not. Veterinarians - continue reading. Dog owners - continue reading.

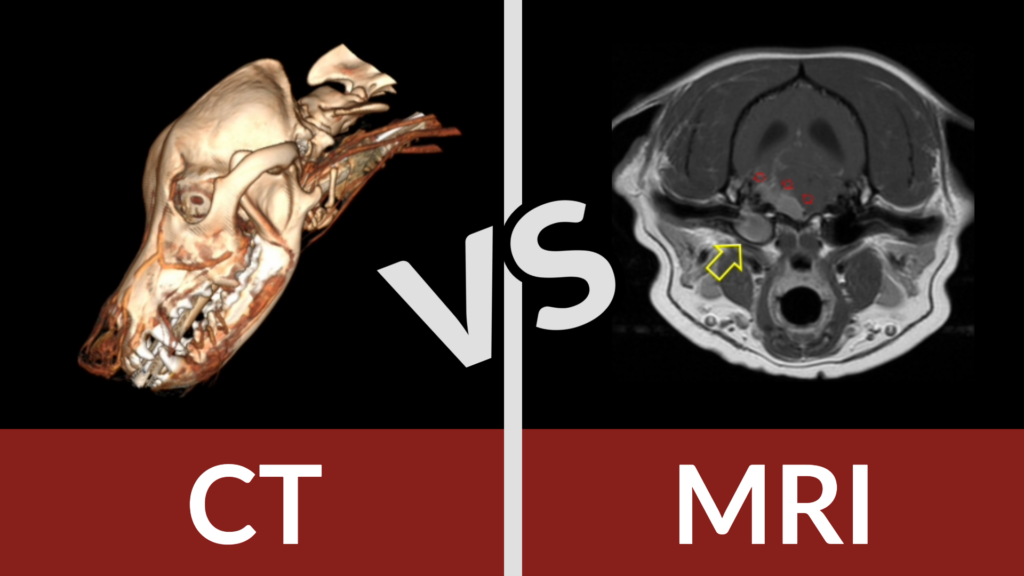

When a patient with suspected neurological disease presents to Veterinary Neurology & Imaging of the Chesapeake, there are a number of steps in the process of identifying, diagnosing and treating their condition...

The post CT vs. MRI: Understanding Neurodiagnostics for Your Pet appeared first on MDVMA.

Company Booth # Antech Diagnostics 12 Banfield Pet Hospital 8 Blue Buffalo Company 24 Boehringer Ingelheim Animal Health 16 Christian Veterinary Mission 13 Compass Veterinary Neurology & Imaging 3 Dulaney Valley Pet Loss Center & Memorial Gardens 4 Everhart Veterinary Medicine 10 First National Bank 22 MWI Animal Health 1 Nexus Veterinary Specialists 17 Nutramax …

Summer Conference Exhibitors Read More »

The post Summer Conference Exhibitors appeared first on MDVMA.

Get the inside scoop on the 2023 legislative session in Maryland and stay up to date with important bills affecting veterinary services and animal welfare. Discover which bills passed, including SB390/HB325 which underwent crucial amendments to ensure the well-being of animals. Find out why HB1227, the bill involving veterinarians as dispensers, did not pass and what efforts are being made to address this issue in the future. Stay informed and be ready to contribute to the conversation in the next legislative session.

The post 2023 Legislative Update appeared first on MDVMA.

MDVMA needs you, our valued members, more than ever. Please take the time to share your concern and/or opposition for House Bill 325 and Senate Bill 390. What is the synopsis? HB 325 and SB 390 will require the State Board of Veterinary Medical Examiners to authorize a veterinary practitioner licensed, certified, or otherwise authorized to practice veterinary …

Concern for HB 325 / SB 390 – Provision of Veterinary Services – Routine Medical Care and Rabies Vaccines Read More »

The post Concern for HB 325 / SB 390 – Provision of Veterinary Services – Routine Medical Care and Rabies Vaccines appeared first on MDVMA.

Dr. Matthew Weeman, DVM, MSBoard of Directors Food Animal RepresentativeChair, Legislative Committee This past session your MDVMA and AVMA both used membership dollars to work hard on your behalf testifying on multiple, critical legislative items. For the first time in Maryland’s history a bill to reward non-economic damages was introduced. This bill was more …

Legislative Update and Request for Your Assistance Read More »

The post Legislative Update and Request for Your Assistance appeared first on MDVMA.

Certified Safety Training offers MDVMA members fully customized and discounted Veterinary OSHA Safety Programs including unlimited online training modules, Certified Safety Data Sheets and dedicated compliance consulting. Veterinary OSHA Compliance Programs give veterinarians and practice managers a comprehensive review of the requirements of select health and safety standards. Each program comes with a written compliance plan, …

MDVMA Partners with Certified Safety Training to Provide Custom Veterinary OSHA Safety Services Read More »

The post MDVMA Partners with Certified Safety Training to Provide Custom Veterinary OSHA Safety Services appeared first on MDVMA.

By Jessica DeCesare, Chief People Officer, VetEvolve People rarely (if ever) go into the veterinary industry without having a true passion for it. You may even remember the specific moment when you decided to have a career in veterinary medicine. Maybe it was when you got your first puppy, your first time riding a horse …

Putting Employees’ Happiness at the Forefront Read More »

The post Putting Employees’ Happiness at the Forefront appeared first on MDVMA.